“The market, if it can be kept honest and competitive, does provide very strong incentives for work effort and productive contributions. In their absence, society would thrash about for alternative incentives-some unreliable, like altruism; some perilous like collective loyalty; some intolerable, like coercion or oppression.”

On Friday, July 29th, the Commerce Department reported that the economy grew at a meager annual rate of only 1.2 percent for the second quarter, compared with Wall Street estimates of 2.6 percent -- a big miss. GDP growth also was revised down to 0.8 percent from 1.1 percent estimate for the first quarter.

The one bright spot in the second quarter was consumer spending, but the consumer can’t drive growth single-handedly.

Higher Uncertainty

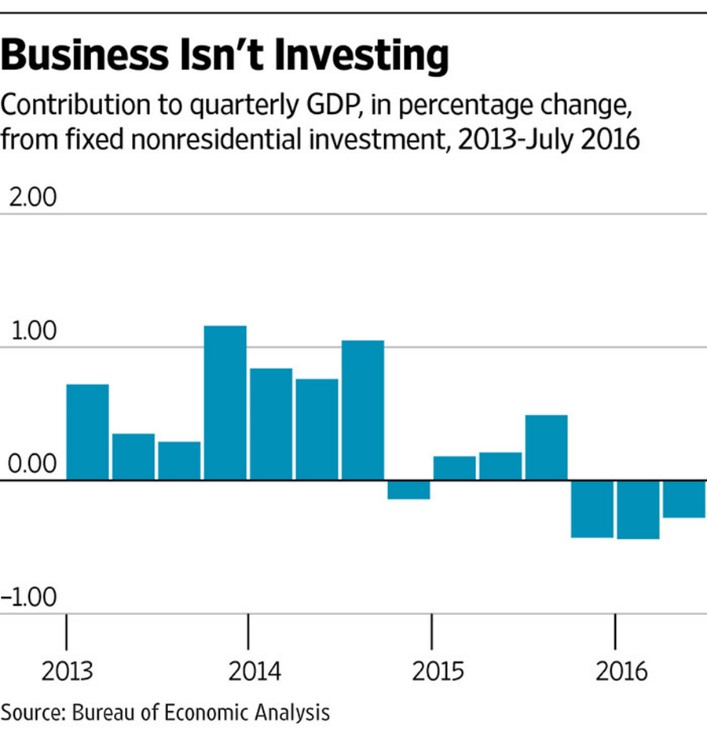

Business investment went into negative territory for the second quarter, reflecting higher uncertainty about the economic and political outlook. Until they have a better sense of the regulatory environment post-election, CEOs will be conservative with their balance sheets and hold off on investing new capital.

In our January post entitled “Outlook 2016: correction or crisis?”, we cited the following astute insight from UBS analyst, Stephen Caprio: “While bank lending standards are healthy, we ultimately believe this misdiagnoses the pulse of the corporate credit cycle. Nearly all of the additional financing provided to nonfinancial corporates has come from non-bank sources, post-crisis.” Caprio continued, “In short, non-bank liquidity has been the main driver of the corporate credit cycle post-crisis, and there are now early signs that it is evaporating.”

In Brief

- The current economic recovery that began in March 2009 is the weakest since World War II.

- Stock Market Valuation: the forward 12-month P/E ratio is 17.0, above the 5-year and 10-year averages and median of 14.63. This P/E ratio is based on Thursdays closing price of 2170.06, and the forward 12-month EPS estimate is $127.93. [1] Earnings came in at $120 in 2015.

- The Dollar/Yen & Treasuries: the headwind of a stronger dollar in 2015 is now a tailwind for earnings. My mother traveled to Japan a year ago and $1= 123 yen…today, $1=101 yen. The 10-year treasury yield then was about 2.20 percent...today, 1.54 percent. Both are considered safe-haven asset classes and signs of risk aversion by global investors.

national debt: $19.2 trillion

Another harsh reality: as of June 2, 2016, the national debt is a whopping $19.2 trillion, nearly double what it was prior to the Obama presidency. justfacts.com/nationaldebt.asp.

This amounts to:

- 105% of the U.S. gross domestic product.[2]

- 51% of annual federal revenues.[3]

In CWM's "Is this the end of our Goldilocks economy", we cited that: "according to a Congressional Budget Office (CBO) report released in January of this year, once the Fed begins raising rates, the 10-year Treasury note will begin rebounding to its historic norm and reach 4.6% by 2025. This return to normalization will raise our national debt payments from $227 billion a year in 2015 (1.3% of GDP) to over $820 billion by 2025 (3.0% of GDP, the highest ratio since 1996). Future costs of servicing our national debt due to higher interest rates could present a real drag on GDP."

The summer of our Disenchantment

After watching both the Republican and Democratic conventions, I didn’t come away feeling enthusiastic about the prospects for a stronger economy. The middle class continues to lose ground in America and abroad, feeling disenfranchised and very concerned for their future. This same atmosphere led to the rise of the populist movement towards de-globalization that resulted in Brexit, the United Kingdom exiting the European Union.

We can’t afford another lost decade in our markets due to lax oversight of Wall Street, misaligned corporate interests, and a dysfunctional government. Unless American leadership get it's act together, we could be headed for a prolonged period of economic secular stagnation. In simple terms, we need real growth spurred by business investment from the private sector and smart fiscal policy. It’s the only way to increase economic growth, create jobs, raise wages, and promote the American Dream for all.

Sources: The Wall Street Journal Online; Bloomberg News; Forbes.com; The Economist.com; CNBC News; CNN Money.com.

Footnotes:

1. FactSet Earnings Insight, July 29, 2016

2. Dataset: “Table 1.1.5. Gross Domestic Product.” U.S. Department of Commerce, Bureau of Economic Analysis, May 27, 2016. <www.bea.gov>

3. Dataset: “Table 3.1. Federal Government Current Receipts and Expenditures.” U.S. Department of Commerce, Bureau of Economic Analysis, May 27, 2016. <www.bea.gov>