Market corrections happen, but the speed of this decline was the fastest 10%+ one since the Great Depression. The extreme whipsaw moves we witnessed occurred because the market is attempting to reprice risk assets based on outcomes ranging from a brief pause in Q2 economic growth to a global pandemic and recession.

Summary

While economic risks are rising, I do not believe the U.S. is heading for a recession or prolonged bear market. Given the risks to Q2 earnings, I am lowering our S&P 500 year-end target from 3400 to 3200.

The market was overvalued in certain areas as I stated in our Market Outlook: Investment Themes for 2020, but valuations are not as stretched as they were during the housing bubble and dot-com era. This is not a 2000- or 2008-style correction.

Don’t bet against the Fed

As my brother Michael, an astute economist, stated on March 1: “We are witnessing a supply-driven shock that the world has never experienced before. There’s no playbook for this one.” The novel COVID-19 virus continues to spread outward from China causing widespread fear. The good news is that the Fed and other central banks were proactive, instead of reactive, and moved this past week to stabilize markets by providing additional liquidity. However, it’s not enough. The Fed and the Whitehouse need to embrace a "whatever it takes" mentality. Trading algorithms need to shift from “what if” to “what will” scenarios and this requires a clear plan from our government.

Some market pundits have criticized the Fed’s recent move because they believe monetary policy cannot cure a non-financial “black swan-type” event. However, lower rates will help interest rate-sensitive companies refinance debt — companies that otherwise could find themselves in violation of debt covenants. There are trillions of dollars of debt owed by businesses and refinancing could help a company weather the current storm, potentially taking advantage of opportunities as animal spirits get stirred.

Collapsing oil prices, empty malls, and idling airplanes will have cash flow implications, which could lead to a slowdown in business spending and bankruptcies. However, it’s an overreaction by markets to assume that the global downturn caused by a supply-driven shock and Wuhan virus could lead to a major credit event.

Corporate Profits

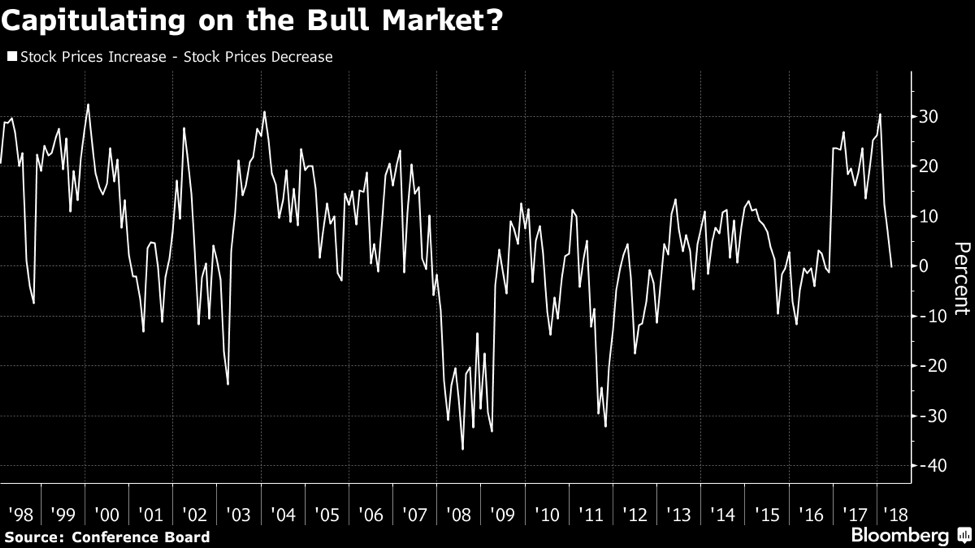

Corporate profits likely will come under severe pressure around the world in the months ahead. The sudden oil price collapse and bond market are signaling a global recession. Many market participants fear that we could see more market capitulation in the near-future as Wall Street analysts lower their estimates.

Analysts had conservative forecasts heading into 2020. I noted in Market Outlook: Investment Themes for 2020 that, according to FactSet Earnings Insight, January 10, 2020, “Targets & Ratings: Analysts Project 6% Increase in Price Over Next 12 Months. The bottom-up target price for the S&P 500 is 3,474.50.”

Valuations: Cheap or trapdoor?

Investors may be wondering whether the pullbacks represent buying opportunities or a “value trap” that could lead to more losses. While valuations are more attractive than they were a few weeks ago, it’s a secondary consideration to economic fundamentals, which continue to deteriorate.

I continue to reevaluate tactical positions in light of these current weakening fundamentals. Certain investment themes and names that I liked a month ago look even more appealing now. However, longer-term shocks to supply-and-demand could lead to lower valuations for stocks as investors discount future earnings more aggressively due to persistently slower growth.

Strategy and outlook

Time vs. timing the market

We could remain in a choppy market environment for months. Cambridge model portfolios held high cash positions relative to their strategic asset allocation heading into this market meltdown.

I stated in Market Outlook: Key Investment Themes for 2020 that the market was overvalued and current exuberance needed a healthy dose of reality. However, positioning portfolios to their fully invested strategic asset allocation will depend on the containment of the COVID-19 virus over the coming weeks, improving market fundamentals, and a coordinated, clear plan from the White House.

JP Morgan’s global asset strategist, Marko Kolanovic, said in a note to clients on Wednesday: “The hit to the global economy during the first quarter will largely be made up later in the year. The world economy will bounce back quickly from the coronavirus outbreak, and investors should buy into cyclical stocks to catch the comeback.” Indeed, when we do see an eventual rebound, I believe deep cyclical sectors and value styles could outperform.

Market bottoms are impossible to time. But, if one focuses on buying great assets at discounted prices while balancing risk and return, Cambridge Wealth Management’s clients will benefit in the long run.

IMPORTANT DISCLOSURES: This information is educational in nature and is not intended to provide specific investment advice, a financial promotion, or an inducement or incitement to participate in any product, offering or investment. Cambridge Wealth Management is not adopting, making a recommendation for or endorsing any investment strategy or particular security. The opinions and information expressed herein are obtained from sources believed to be reliable. However, their accuracy and completeness cannot be guaranteed. All data is driven from publicly available information and has not been independently verified by Cambridge Wealth Management, LLC. Some of the conclusions in this report are intended to be generalizations. Any economic forecasts and statements set forth may not develop as predicted and are subject to change. Undue reliance should not be placed on such statements because, by their nature, they are subject to known and unknown risks and uncertainties. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal.

INDEX DESCRIPTIONS:

The following descriptions, while believed to be accurate, are in some cases abbreviated versions of more detailed or comprehensive definitions

available from the sponsors or originators of the respective indices. Anyone interested in such further details is free to consult each such sponsor’s or originator’s website. Each index reflects an unmanaged universe of securities without any deduction for advisory fees or other expenses that would reduce actual returns, as well as the reinvestment of all income and dividends. An actual investment in the securities included in the index could require an investor to incur transaction costs, which would lower the performance results. Indices are not actively managed and investors cannot invest directly in the indices.

S&P 500®: Standard & Poor’s (S&P) 500®) index. The S&P 500® Index is an unmanaged, capitalization-weighted index designed to measure the performance of the broad US economy through changes in the aggregate market value of 500 stocks representing all major industries.